Revolutionising Taxation

The Netherlands Tax Administration’s Journey to Real-Time Compliance

Compliance Targets

In an era of rapid digital transformation, the Netherlands Tax Administration faced the challenge of modernising its taxation system. mintBlue’s innovative distributed ledger technology solution paves the way for a groundbreaking shift towards real-time taxation, benefiting both the administration and taxpayers.

The Challenge:

Modernising a Nation’s Tax System

The Netherlands Tax Administration, responsible for managing tax processes for an entire nation, grapples with an outdated quarterly tax filing system. This legacy approach leads to:

High administrative burdens for businesses

Inefficient and time-consuming auditing processes

Delayed tax adjustments, causing financial uncertainty

The vision was clear

Create a future where tax assessment and collection would be performed automatically and in real time, unburdening citizens and entrepreneurs while increasing overall compliance and trust in government.

The mintBlue Solution:

Turning Compliance into a Competitive Advantage

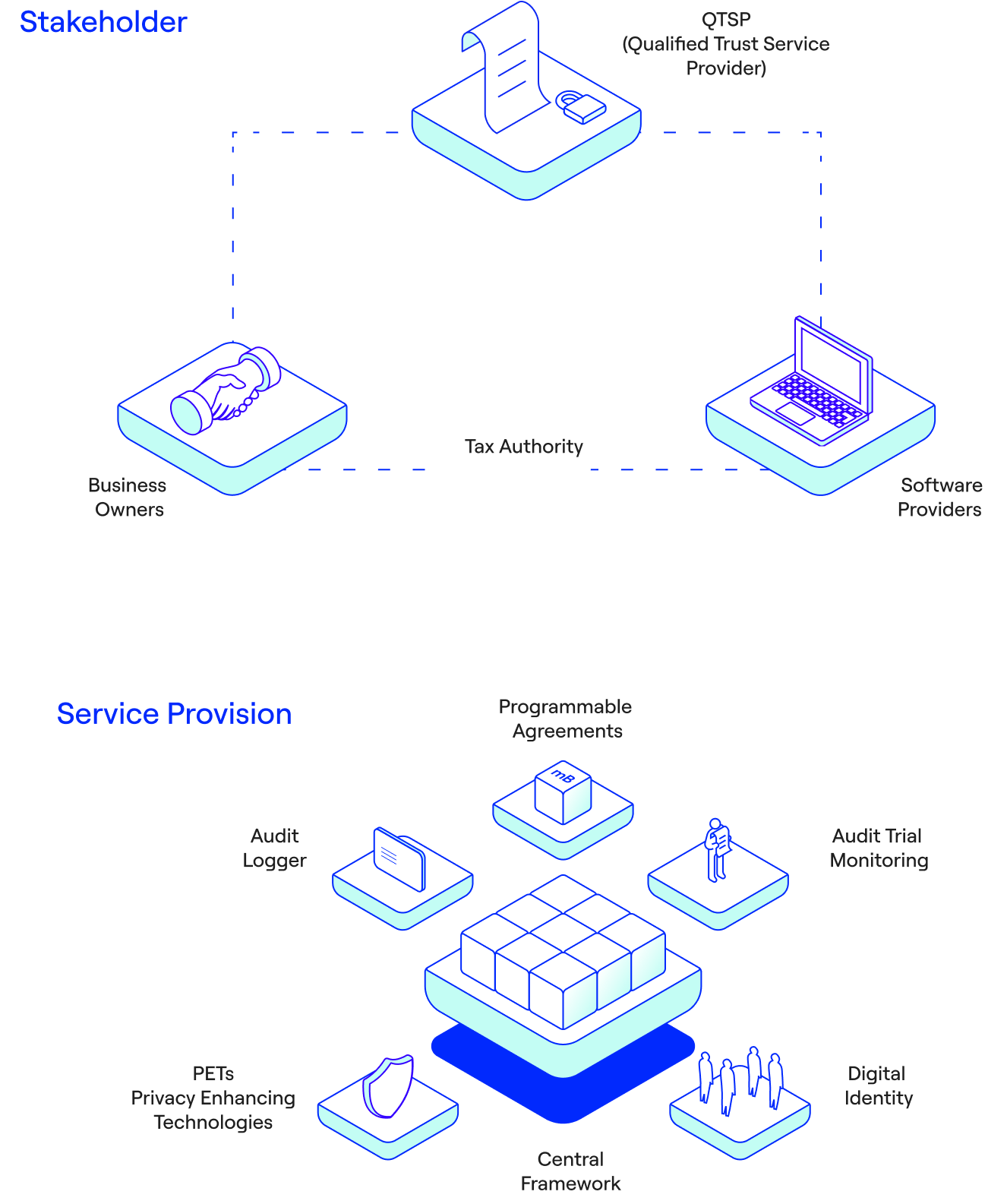

Our approach leverages cutting-edge distributed ledger technologies to create a seamless, secure, and efficient real-time taxation system. At the core of our continuous transaction control implementation are:

Tax

Plugin

Seamlessly integrates with existing accounting software, automatically recording and processing every invoice in real time.

Distributed Ledger

Provides an unalterable record of all transactions, ensuring transparency and trust.

Digital Identities

Enables secure, verifiable transactions without compromising privacy or requiring a centralised authority.

Tokenisation System

Facilitates automated VAT calculation and settlement, streamlining the entire process.

This comprehensive implementation will set the new standard for business integrity in taxation, turning a traditional compliance challenge into a competitive advantage for the Netherlands.

Transforming Promises

into Provable Facts

The implementation of mintBlue’s real-time taxation solution will deliver substantial benefits.

These metrics would underscore the power of our trust-amplifying technology in revolutionising taxation processes.

Reduction in time spent on tax calculations by businesses

Improvement in tax assessment accuracy

Increase in timely tax submissions

Annual administrative cost savings for the Netherlands Tax Administration

A Gold Standard for Business Integrity

“With mintBlue’s distributed ledger, we’ve created a secure, private solution for peer-to-peer invoice exchange. This automation not only makes taxation easier, but also significantly reduces administrative burden for business owners.”

Claire Arens

Strategy Lead, Netherlands Tax Administration

Setting the Foundation for Future Innovation

A successful implementation of real-time taxation in the Netherlands will pave the way for broader innovations.

As we continue to refine and expand this solution, we’re excited about the possibilities it opens up for governments and businesses alike.

Potential adoption by other EU member states, creating a more unified and efficient European tax system

Integration with digital identity initiatives, such as self-sovereign identity (SSI) and verifiable credentials (VC), further streamlining administrative processes

Expansion to other areas of taxation, building on the proven success of VAT automation

Transform Your Promises into Provable Facts

Discover how our trust-amplifying technology can power your data governance and compliance strategy, turning challenges into competitive advantages.